The landscape of clinical diagnostics in Europe is undergoing a massive transformation. As laboratories across the continent strive for higher precision in hematology and molecular testing, the demand for high-quality specimen collection tools has never been greater. At the heart of this shift lies the European EDTA Tubes Market, a sector defined by its rigorous safety standards and complex distribution networks. For healthcare providers, laboratory managers, and medical distributors, understanding how to navigate this market—specifically regarding CE marking and regulatory compliance—is no longer optional; it is a fundamental requirement for operational success.

When we talk about blood collection, the EDTA (Ethylenediaminetetraacetic acid) tube is the gold standard for preserving cell morphology. However, entering or expanding within the European territory requires more than just a good product. It requires a deep dive into the European Union’s In Vitro Diagnostic Regulation (IVDR), which ensures that every tube used in a clinical setting meets the highest safety benchmarks. This article provides a comprehensive look at the trends, regulations, and procurement strategies shaping the European EDTA Tubes Market today.

The Dynamics of the European EDTA Tubes Market

The European healthcare sector is characterized by its diversity and its commitment to standardized quality. From the centralized laboratories in Germany to the rapidly expanding private diagnostic centers in Poland, the European EDTA Tubes Market is growing at a steady pace. This growth is driven by an aging population, an increase in chronic disease prevalence, and a heightened focus on early disease detection through routine blood work.

In Europe, EDTA tubes are primarily utilized for hematological examinations, such as Complete Blood Counts (CBC), and specialized genetic testing. Because European labs prioritize automation, there is a significant preference for tubes that offer consistent vacuum pressure and standardized dimensions. Whether you are looking at EDTA tube sizes explained or investigating specific volumes for pediatric care, the European market demands versatility and precision.

The Shift Toward High-Performance Diagnostics

One cannot discuss the European EDTA Tubes Market without mentioning the technological shift toward molecular diagnostics. Modern European labs are increasingly using K2 EDTA and K3 EDTA tubes for viral load testing and DNA sequencing. This shift has forced manufacturers to refine their production processes to ensure that tubes are free from contaminants that could interfere with sensitive PCR (Polymerase Chain Reaction) assays. For those in the procurement phase, consulting a complete guide to EDTA tubes is essential to distinguish between standard hematology tubes and those optimized for advanced molecular applications.

The Critical Role of CE Marking in Europe

If you intend to distribute or use medical devices within the European Economic Area (EEA), the CE mark is your “passport.” In the context of the European EDTA Tubes Market, the CE mark signifies that the product complies with the essential requirements of relevant European health, safety, and environmental protection legislation.

From IVDD to IVDR: A Regulatory Evolution

For years, the In Vitro Diagnostic Directive (IVDD) governed the market. However, the transition to the In Vitro Diagnostic Regulation (IVDR 2017/746) has raised the bar significantly. Under the IVDR, blood collection tubes are classified more strictly, requiring more robust clinical evidence and documentation. For stakeholders in the European EDTA Tubes Market, this means that sourcing from quality EDTA tube manufacturers in China or other international hubs requires verifying that the manufacturer has updated their technical files to meet these new, stringent EU standards.

CE marking is not just a sticker on the box. It represents a commitment to:

Analytical Performance: Ensuring the anticoagulant-to-blood ratio is exact.

Stability: Guaranteeing that the vacuum remains intact throughout the shelf life.

Safety: Minimizing the risk of tube breakage or leakage during centrifugation.

Distribution Channels in the European EDTA Tubes Market

The distribution of medical consumables in Europe is a multi-layered process. Large-scale hospital groups often procure directly from manufacturers or Tier-1 distributors, while smaller clinics and private labs rely on local medical supply companies. For an international manufacturer to penetrate the European EDTA Tubes Market, they must establish a reliable supply chain that accounts for logistics, warehousing, and local language labeling requirements.

Strategic Sourcing and Lead Times

In the current economic climate, European buyers are looking beyond just the price. They are evaluating the total cost of ownership, which includes shipping reliability and the ability to provide various sizes, from 2ml to 10ml EDTA tubes. Many European distributors are now forming long-term partnerships with manufacturers like Siny Medical to ensure a steady flow of inventory that meets European quality benchmarks.

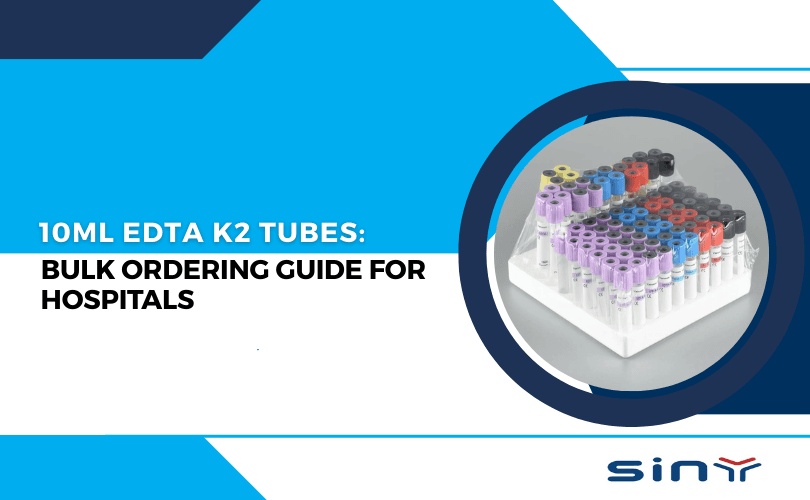

| Feature | K2 EDTA (Plastic) | K3 EDTA (Glass/Plastic) |

| Common Use | Hematology, Molecular | Routine Blood Testing |

| EU Preference | High (Less cell shrinkage) | Moderate |

| Standard Sizes | 2ml, 3ml, 5ml | 5ml, 7ml, 10ml |

| CE Status | Mandatory for EU Market | Mandatory for EU Market |

Technical Specifications: Meeting European Lab Standards

European laboratories are highly automated, using sophisticated track systems and high-speed centrifuges. This environment dictates the physical requirements of the tubes. In the European EDTA Tubes Market, “one size fits all” simply does not work. Labs must carefully choose the right EDTA tube based on their specific equipment and the volume of blood required for the requested tests.

Volume and Dimensions

The choice between a 10ml tube and a 5ml tube often depends on the diagnostic panel. For example, in many European research hospitals, larger volumes are preferred for biobanking, while standard 3ml or 5ml tubes are the workhorses of routine outpatient clinics. Ensuring that these tubes fit seamlessly into analyzers from brands like Roche, Siemens, or Sysmex is a top priority for participants in the European EDTA Tubes Market.

Comparing EDTA with Other Collection Systems

To understand the dominance of EDTA in the European EDTA Tubes Market, one must compare it with other anticoagulants. While heparin tubes are used for plasma chemistry and citrate tubes for coagulation, EDTA remains unrivaled for cellular morphology. A detailed comparison of EDTA tubes vs other tubes reveals that the binding of calcium ions by EDTA is the most effective way to prevent clotting without distorting the white and red blood cells.

This stability is why EDTA tubes for hematology testing are the primary product moved through European distribution channels. Without them, the high-throughput CBC testing that European healthcare relies on would be impossible.

Sustainability and Innovation in the European Market

A unique aspect of the European EDTA Tubes Market is the growing emphasis on environmental sustainability. The EU Green Deal and various national initiatives are pushing laboratories to reduce plastic waste. Consequently, there is a rising interest in “eco-friendly” tube designs—tubes that use less plastic without compromising the vacuum seal or the integrity of the sample.

Furthermore, innovation in “smart” labeling and RFID integration is starting to take root in Europe. These technologies help reduce pre-analytical errors, which are estimated to account for up to 70% of all laboratory mistakes. Manufacturers who can integrate these features while maintaining CE compliance will likely see a significant advantage in the European EDTA Tubes Market.

Challenges in the Current European Market

Despite the growth, the European EDTA Tubes Market faces several challenges. Inflation and rising energy costs in Europe have led to increased prices for raw materials like medical-grade PET plastic. Additionally, the administrative burden of IVDR compliance has caused some smaller manufacturers to exit the market, leading to temporary supply chain bottlenecks.

To mitigate these risks, many European procurement officers are diversifying their supplier base. They are increasingly looking toward global suppliers on platforms like Made-in-China who have already secured the necessary European certifications. This strategy ensures that even if one region faces logistical hurdles, the laboratory’s operations remain uninterrupted.

How to Choose a Supplier for the European Market

If you are a distributor looking to enter the European EDTA Tubes Market, your choice of partner is critical. You need a manufacturer that understands the nuances of European regulations. When evaluating potential partners, consider the following checklist:

Regulatory Documentation: Does the manufacturer provide a clear Declaration of Conformity and valid CE certificates?

Product Range: Do they offer the full spectrum of sizes, including 3ml, 5ml, and 10ml options?

Quality Control: Are the manufacturing facilities ISO 13485 certified?

Support: Can they provide technical data sheets in English or other European languages?

For those ready to explore high-quality options, you can browse a wide range of EDTA tube products specifically designed to meet international standards.

The Future of the European EDTA Tubes Market

Looking ahead, the European EDTA Tubes Market is expected to become even more specialized. We are likely to see a surge in the use of K2 EDTA tubes with gel separators, which allow for easier transport of plasma samples across long distances—a common occurrence in the era of centralized “mega-labs.”

Moreover, as the European Union continues to harmonize healthcare standards across its member states, the demand for high-consistency, CE-marked consumables will only intensify. Staying informed through resources like the Siny Medical YouTube channel can provide visual insights into the manufacturing excellence required to compete in this demanding arena.

Summary

In conclusion, the European EDTA Tubes Market is a sophisticated ecosystem where quality, regulation, and distribution efficiency intersect. Success in this market requires a deep understanding of CE marking and the IVDR framework, as well as a strategic approach to sourcing. By prioritizing compliant, high-performance products and building resilient supply chains, healthcare providers can ensure that they are delivering the best possible diagnostic outcomes for patients across Europe.

Whether you are looking for specific EDTA tube categories or seeking advice on lab optimization, the European market rewards those who do their homework. For personalized inquiries or to discuss distribution opportunities, feel free to contact us directly.

FAQs

What is the European EDTA tubes market size?

The European EDTA tubes market is valued at €220 million (2025), growing steadily due to rising diagnostic needs.

Why is CE marking important for EDTA tubes?

CE marking ensures EDTA tubes meet EU safety standards, allowing legal distribution in Europe.

Which EDTA tube size is best for hematology testing?

Most labs use 3mL or 5mL EDTA tubes (see our EDTA tube size guide).

Can I import EDTA tubes from China to Europe?

Yes, but ensure the manufacturer has CE certification (learn more about Chinese EDTA tube suppliers).

How do EDTA tubes compare to heparin tubes?

EDTA tubes are preferred for hematology, while heparin tubes are used for chemistry tests (see comparison guide).